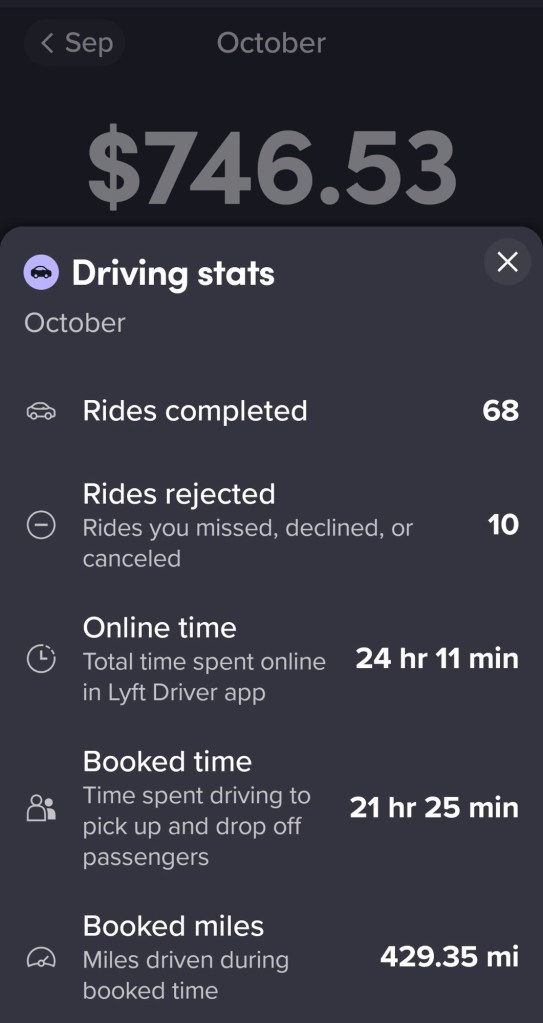

Recently, I had the opportunity to get my hands on an economical low mileage car in good condition for a very cheap price. I got it specifically to use it as a rideshare car. When I tried to sign onto Uber and Lyft, I had issues with Uber changing my city that were going to require customer service, and as I was getting nowhere with them, I just started driving for Lyft as soon as they approved me. The experience of driving for rideshare or doing app work varies greatly from city to city and I was eager to see how it worked out in Pittsburgh. I work a full-time job and was only looking for supplemental income. My goal would be to work 2-3 nights for a few hours and make about $250 a week.

From what I have experienced working the late night crowd in Pittsburgh, I usually average about $30 an hour before expenses or taxes. I figure that wear & tear on the car and fuel are probably good for about $10 an hour. In the Lyft Driver pay app you can actually set aside a percentage of your pay to go to the savings account and I use that to try to separate my car expense so that I have money for repairs and maintenance.

This gets to the first part of the strategy, which is using the Lyft Driver pay app to get paid instead of getting paid directly to your own account. By doing this, you can keep the extra money separate from your normal finances. It also gives you a separate bank account that you can link to your Upside account. By doing this, it allows me to use the money that I get from driving Lyft for the expenses that will give me rewards from Upside and the grocery store without granting them access to every transaction of my life. The Lyft Rewards program also allows you to buy $5 gas coupons with your points, so after a month you can get $5 back on every tank.

This brings us to the second part of the strategy, which is using Upside for all of your gas and grocery transactions. By linking the Lyft pay card to the Upside account, there are additional bonuses as well. Depending on the size of your family unit, how much gas you consume, and how much groceries you buy, your results could vary widely. My results are based on a single person that lives very frugally and is often fed by their loving partner. I don’t spend a lot on food, and I don’t have a long commute. I do use Upside to scan the receipts when I fill up my work truck and although my expense card is not linked to the account I still get rewards. For a 32 gallon tank, I often get about $6, and that is before the grocery points.

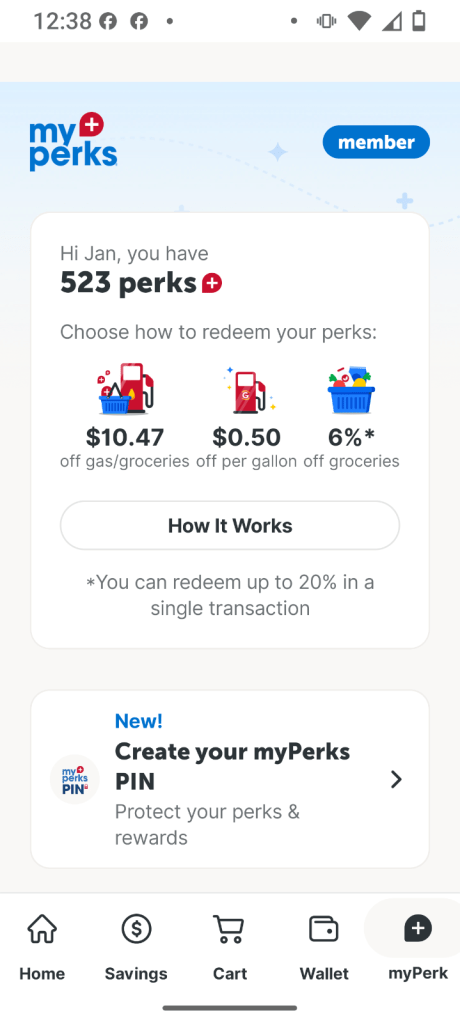

The final step in the chain is the gas and grocery rewards. In my area, we have Giant Eagle and GetGo that are owned by the same company. You earn rewards at both the gas station and the grocery store and can use them in either place. By always choosing to do my shopping and fill my tank at these gas stations and grocery stores I get additional rewards, regardless of which credit card I use. This really is the cherry on top of the sundae.

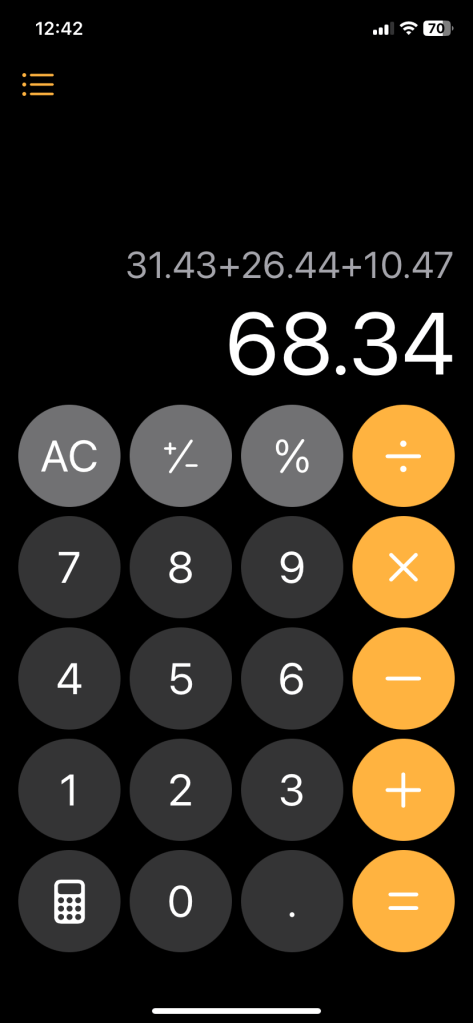

By using this strategy, as a single person who doesn’t drive or shop much, and only worked 25hrs additional to my regular job for the entire month, I was able to accumulate another $68 worth of savings in October. Whether it be at my day job or my night job, that’s basically putting an extra 3 hours worth of labor in my pocket in a month. People that drive a lot, or feed a large family could benefit greatly from this strategy. It has gotten harder and harder for folks to get by in this economy and every penny we can pinch matters.

If you would like to sign up for Lyft, please use my referral link: Click here

Here is my referral link for Upside: Click here or use code JAN62388

https://www.lyft.com/drive-with-lyft?utm_medium=d2da_iacc

https://upside.app.link/JAN62388

Leave a comment